Continued strong performance and volume-led growth; upgrade to full year guidance[1]

Greencore Group plc (‘Greencore’ or the ‘Group’), a leading manufacturer of convenience foods in the UK, issues its trading update for the fourth quarter (“Q4” or the “quarter”) and full year (“FY25”) ended 26 September 2025, ahead of publication of its FY25 results on 18 November 2025.

PERFORMANCE:

• With another strong quarter in Q4, Greencore concludes an excellent year, with continued progress against its strategy and consistent delivery for customers (99% operational service levels for Q4 and FY25[2]).

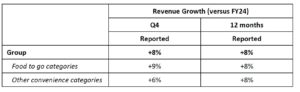

• Revenue growth experienced throughout the year continued into Q4, driven by new business wins, new product innovation and favourable weather. The Group now expects to report FY25 revenue of approximately £1.95b.

• Volume momentum continued into Q4, particularly food-to-go categories such as sandwiches and sushi. This brings to a close a year of robust volume growth, with FY25 manufactured volume growing approximately 3% and underlying volume growing 1% (excluding new business wins).

• Product innovation was a strong contributor to growth. 130 new products were launched during Q4, including a range of hot and cold food to go products for a new store format, an elevated mac and cheese range and premium cooking sauces.

• Profit conversion during Q4 was ahead of expectations. This performance was driven by strong volume momentum and a focus on cost management through the Group’s excellence initiatives, including reducing waste and ensuring effective use of labour at sites.

• The Group continues to drive strong cashflow and strengthen its balance sheet. Net Debt (excluding lease liabilities) is expected to be approximately £70m (FY24: £148m), with Net Debt to EBITDA well below the medium-term target range of 1.0x – 1.5x (as measured under financing agreements).

OUTLOOK:

• As a result of this strong performance, the Group now anticipates FY25 Adjusted Operating Profit will be approximately £125m, above previous guidance[1].

• The Group continues to progress with the proposed acquisition of Bakkavor Group plc, after approval was received for the transaction from both Greencore and Bakkavor shareholders in July. As anticipated, the Competition and Markets Authority announced the launch of its merger inquiry, with a deadline of 27 October for its Phase 1 decision.

• Greencore expects to report its FY25 results on 18 November 2025.

With the consent of the Bakkavor Group plc, the UK Panel on Takeover and Mergers has confirmed that the foregoing statement in relation to FY25 Adjusted Operating Profit (the “Profit Estimate”) constitutes an ordinary course profit forecast for the purposes of Note 2(b) to Rule 28.1 of the City Code on Takeovers and Mergers (the “Takeover Code”), to which the requirements of Rule 28.1(c)(i) of the Takeover Code apply. The additional disclosures required by the Takeover Code are set out in the Appendix to this announcement.

Dalton Philips, Chief Executive Officer

“We had another excellent quarter in Q4, which rounded out an exceptional year. I am proud of the Greencore team for the passion and commitment they bring each day, allowing us to deliver for our customers. While there are wider economic headwinds, the strong performance means we are again upgrading our full year guidance.

Our focus in the new financial year remains on producing high-quality, fresh food for consumers across the UK. We look forward to completing the Bakkavor transaction, subject to regulatory approval, and remain excited about the potential of combining two great UK food businesses, enhancing our product offering for our customers and UK consumers.”

Click here to download the full statement

1. Previous guidance communicated as part of the Q3 Trading Statement on 22 July 2025 was FY25 Adjusted Operating Profit of £118-121m. For reference, company compiled consensus as at 6 October 2025 for FY25 Adjusted Operating Profit was a range of £119.5m to £121.8m.

2 Net operational service levels, measured as the number of on time and in full orders as a % of accepted customer orders.